Methodology

What Is the AI Index?

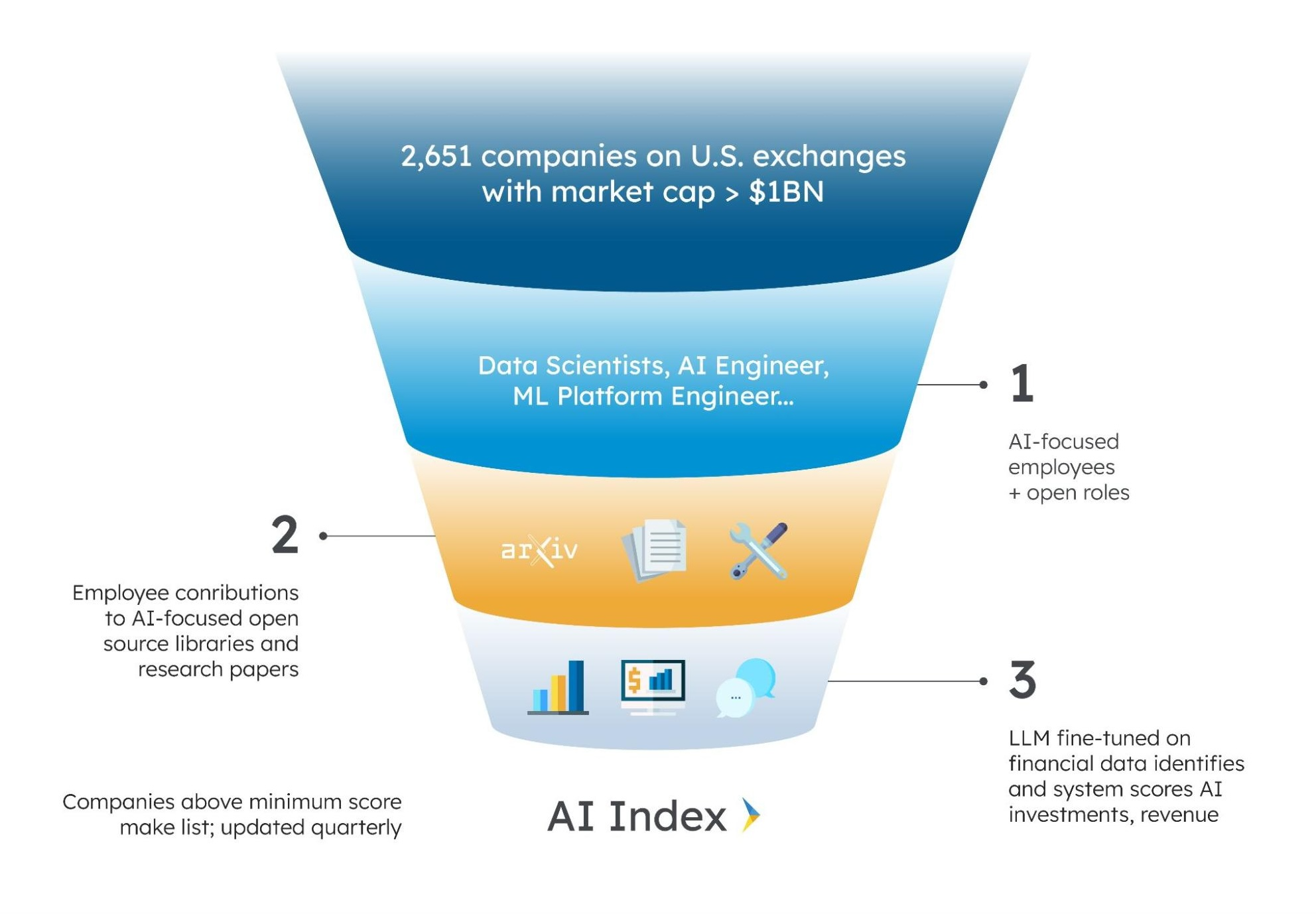

AI Index is the first list purpose-built to separate companies making material investments in AI from those merely incorporating AI into their businesses. The index is an organic outgrowth of Swift's venture capital work investing in private early-stage AI startups and is released with a desire to broaden the gains from the AI revolution to a wider set of investors.

How Companies Are Selected

Swift Ventures built an AI-powered system to select companies, leveraging a fine-tuned LLM to analyze earnings and regulatory filings as well as data from a variety of sources to determine levels of AI investment, hiring, team composition, and employee contributions to AI research and open source models and tools.

For background and more details on what powers the list, check out this launch blog: Introducing AI Index.

Eligible Exchanges

The Nasdaq Stock Market and the New York Stock Exchange, the NYSE American.

Eligible Securities

Common stock, ordinary shares and American Depository Receipts (ADRs) of companies selected by the Swift Ventures team.

Market Capitalization

Included securities have a market capitalization of at least $1BN for over half the days of the previous quarter.

Seasoning

Securities are required to be listed on an eligible index for at least three months on the exchange.

Liquidity

Each stock must have a minimum three-month average daily dollar trading volume of $5 million.

Update Frequency

The index is typically updated on a quarterly basis.

Index Removal

Companies that do not meet Swift Ventures’ AI criteria or that are acquired or delisted will be removed at the time of the next index update.